Last month, prime minister Tan Sri Muhyiddin Yassin announced a six-month bank loan repayment moratorium for all Malaysians. The relief programme is similar to what was offered in the first round of the movement control order last year, and those who require assistance can submit their applications from today.

Prior to this, financial institutions have continued to provide targeted repayment assistance to individuals impacted by Covid-19 and movement control orders. However, under the new Pemulih plan, the moratorium is available to everyone from the B40 segment right up to the T20, along with micro entrepreneurs.

RHB has updated its Covid-19 relief measures and support page, so let’s explore the options that are available to you via its Repayment Assistance (RA) programme, with a specific focus on car loans.

The bank provides three options to customers, including a deferment of instalments for six months, a 50% reduction of instalments for six months, or a customised reduction in monthly instalment by extension of loan.

It’s up to you to choose what option suits you best, and you can submit your application via the prepared e-Form. You can also contact RHB at 03-2776 3111 or by email ([email protected]), but do check ahead to make sure your preferred branch is open, or if there’s a revision in opening hours.

It’s important to remember that the moratorium is not a loan waiver, so you’re not getting six months of “free instalments.” Instead, your payments are deferred but is accompanied by an extension of the loan tenure by six months as a result – this will also see the total interest paid being higher due to the tenure extension.

RHB didn’t provide an example scenario of how its payment deferment will work in terms of numbers, but it is similar to CIMB’s example, which you can check out. The interest will vary according to your loan amount, remaining tenure and the agreed interest rate, so check with RHB for details before coming to a decision.

RHB also did not provide an example with regards to lowering your monthly instalment by 50% for six months. However, as there is no extension of the loan tenure and monthly instalment remains the same after the six months of 50% off, the outstanding balance is due at the end of the loan tenure, in one lump sum. Basically, the accumulated 50% that wasn’t paid for six months must be paid at the end of the loan.

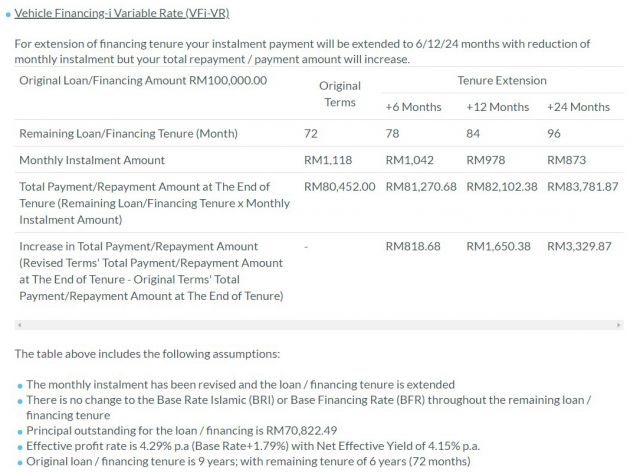

While there are no examples for the first two options mentioned, RHB did provide one that relates to customised reductions in monthly instalment by extension of loan. This option essentially allows you to lower your monthly instalment by increasing your loan tenure, although you’ll need to discuss with the bank on the amount and terms that you are comfortable with.

In RHB’s scenario, there’s a nine-year car loan of RM100,000 at an interest rate of 4.29%, with six years remaining on the tenure. The remaining sum at this point is RM80,452 and the borrower pays RM1,118 per month.

Opting for a lower monthly instalment of RM1,042 with a six-month extension, the total payment rises to RM81,270.68, which is a difference of RM818.68. The bank offers extensions for up to two years, and as you can see in the example, the monthly instalment drops significantly with a longer extension, but at the expense of increase in total payment. As RHB puts it, “we advise you to weigh the short-term benefits against the long-term costs.”

Unlike targeted assistance, there is no need for proof of a pay cut or job loss, and no documents are required. All borrowers need to do is apply with the bank for the moratorium, and sign an amended loan agreement.

Approval is automatic for individual borrowers, and approvals should come within five days if you are qualified. Meanwhile, for companies, it is subject to review by the bank and not automatic. Also, accepting the loan pause will not affect an individual’s CCRIS status and rating, so there’s no need to worry.

Again, contact RHB via phone or e-mail (listed above) for more details on its RA programme, or visit any HLB branch near you.

Tags: COVID-19

Source: Read Full Article