The success of Creta over S-Cross also proves that Indian customers don’t have a herd mentality; they will put their money where they find real value, brand notwithstanding

BHPian pqr recently shared this with other enthusiasts.

Maruti Jimny’s S-Cross moment

“History repeats itself, first as a tragedy, second as a farce.”

Maruti S-Cross (2015), planned with 5,000 units per month sales for the Indian market, has not been successful because of its grown-up hatchback stance, especially when it was expected to have an SUV silhouette like the Renault Duster (2012), and finally, the Hyundai Creta (2015) crushed it to become the segment leader for years to come.

Similarly, the Jimny five-door version planned with 5,000 units per month sales for the Indian market is not working because Mahindra Thar’s 2nd generation (2020) already set the benchmark in terms of expectations in the hearts of Indian audience, and Maruti’s ambitious pricing played a further spoil sport.

Maruti S-Cross: A case study

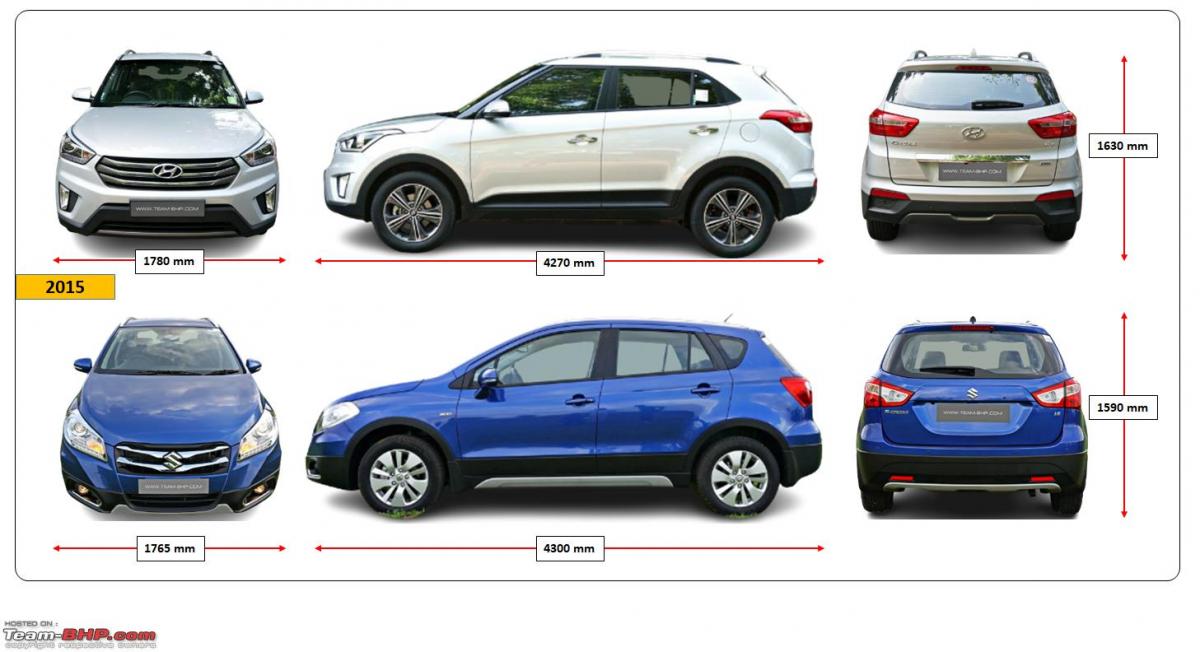

The mid-size monocoque chassis-based compact SUV (~4.3m) has been a high-growth and highly contested segment in India.

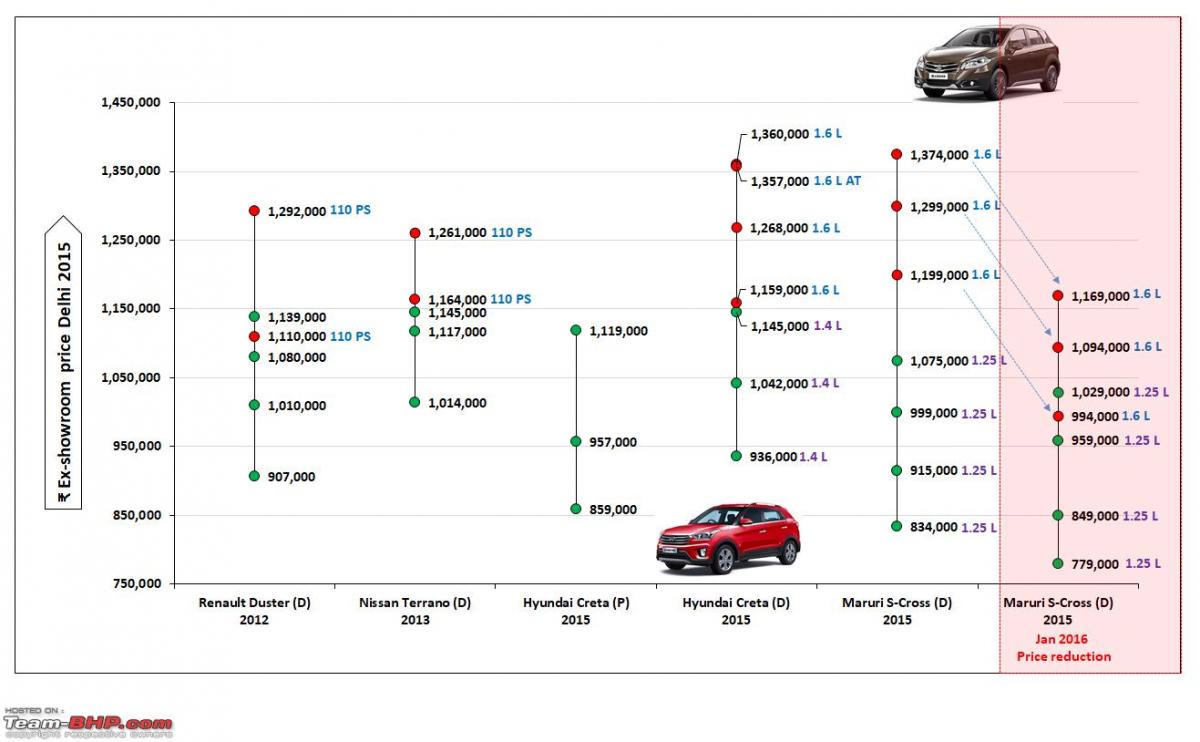

This segment was kicked off by Renault in 2012, when a modified Dacia (Renault’s Romanian subsidiary) Duster with a 1.6L petrol and a 1.5L diesel engine in two different states of power tune, was launched in India under the Renault badge. Despite having budget-grade interiors from East Europe, it caught the imagination of the Indian audience and became an instant hit due to its rugged and outdoorsy compact SUV look.

Fast forward to 2015; this was the time when Maruti and Hyundai decided to pitch in their products in this high-potential segment. Locally made Creta was planned to be launched in September 2015, a month after Maruti S-Cross.

However, Hyundai got scared of Maruti and preponed Creta launch by two months in July 2015. Now this was the time when Indian media used to say that Maruti was scared of only Hyundai, and Hyundai obviously was scared of Maruti, and together they don’t care of anyone else, as they were a very dominant player, commanding over 60% of the Indian passenger vehicle market share (except 2012).

Developed for emerging markets, Hyundai launched the Creta with 1.4L and 1.6L diesel engines and a 1.6L petrol engine, with an automatic transmission option available for the 1.6L diesel engine. Two months down the line, Maruti launched the localized European S-Cross with a ubiquitous locally sourced 1.25L diesel engine from Fiat in higher sate of power tune and another 1.6L imported diesel engine from Fiat, without automatic transmission or petrol option, and no rear AC vent either. S-Cross was perceived to have the best build quality among all the cars Maruti has ever produced locally in India.

Maruti had intended to sell over 5,000 S-Cross each month; however, sales dropped to 2,000 within a few months after its debut. At the same time, Hyundai was selling over 7,000 Cretas a month, and 30% of sales were coming from the petrol version, which the S-Cross doesn’t have. Creta got a tremendous response for its upright SUV stance and overall package, and the uninspiring Maruti S-Cross was drubbed by the Indian audience for its awkward, grown-up hatchback styling.

Immediate corrective action from Maruti

While Hyundai was considering increasing production to meet strong demand, Maruti moved quickly to mitigate the fall in sales.

- Step 1: Discounts: Maruti started offering discounts up to ₹ 1 lakh in October 2015 to arrest the sales fall of S-Cross.

- Step 2: Price reduction: When nothing else was working, Maruti reduced the price of the 1.6L version by over ₹ 2 lakh and the 1.25L version by ₹ 70,000 in January 2016.

- Step 3: Refund: As a goodwill gesture, Maruti refunded ₹ 90,000 to S-Cross customers who bought the 1.6L version before the January 2016 price cut and offered an extended warranty to 1.25L S-Cross customers.

Did that help Maruti get sales back to the originally planned 5,000 units a month? No. It simply settled around 2,000 units, as it was still a better Maruti. The biggest downside from a business perspective is fixed costs (Jeep Compass, Meridian prices hiked by Rs 43,000 to 3.14 lakh!); they eat into profit margins over the life cycle if originally planned volumes are not met. Maruti also has to compensate suppliers for the tooling investment, as with low volume, it became unrecoverable.

After getting bullied by Maruti in the hatchback segment for years, finally, Creta punched S-Cross in the face and took Hyundai’s lunch money back. Since then, Creta went on to become the best revenue-grossing product in the entire Indian passenger vehicle market due to its ever-increasing prices, high average sales price, and high volume.

Here is the surprising part: Maruti, who has always been touted to know the pulse of Indian customers quite well, would have known the fate of S-Cross beforehand during the static customer clinic (market research technique), as the Renault Duster was available as a benchmark car. Still, overconfident Maruti took this route for its own annihilation in this segment.

The success of Creta over S-Cross also proves that Indian customers don’t have a herd mentality; they will put their money where they find real value, brand notwithstanding (Toyota Yaris failure).

S-Cross Facelift

As a next step, Maruti brought in an S-Cross facelift with highly updated fascia akin to BMW in 2017. The improved bonnet line gave it a better crossover stance, but the side profile remained the same, so sales growth was limited to 3,500 units a month in 2018, nowhere close to the originally planned 5,000 units.

Seven months later, Hyundai also launched the Creta facelift, with the segment’s first sunroof and a 6-way electrically adjustable driver seat, raising the bar even higher for everyone in the segment.

The 2nd generation Creta, launched in 2020, raised the bar even further with the democratization of features like panoramic sunroof and electric parking brake in the segment, thus making competition irrelevant for a year or so.

S-Cross successor in India

The third generation of S-Cross was introduced in Europe in 2021. But this time, Maruti gave India a tailored body shell based on a similar Suzuki Global C platform, named Grand Vitara in 2022, that has an upright stance, high ground clearance, a Maruti first panoramic sunroof, and so on. Maruti has to strictly follow Hyundai’s playbook, toe to toe. Still, Maruti Grand Vitara interiors left a lot to be desired in terms of the overall space and finesse of the Hyundai Creta, and the lack of a diesel engine also means Maruti has to play second fiddle to the Creta in the segment. And at the beginning of 2023, Hyundai happily postponed Creta’s facelift by a year in India.

Jimny India chapter

The fourth generation of Jimny with three doors was introduced in Japan in mid-2018. Ever since then, rumors have been rife of the imminent launch of Jimny in India as the aging Gypsy’s successor. However, in September 2019, Maruti’s CTO clarified to Autocar Professional:

[Autocar Professional]: Will the Jimny be a feasible option for Maruti Suzuki?

[C.V. Raman, Maruti CTO]: The three-door is a very niche segment in India. What is required for India is a five-door model. That means we have to do a new development, which would require time and cost. The possible volume against the required investment does not make sense for us.

Well, after this statement in 2019, Maruti showcased 3-door Jimny at Auto Expo 2020 in India, where it received a lot of attention from the crowd.

Continue reading BHPian pqr’s analysis for more insights and information.

Source: Read Full Article