The fleet market share of 17.5% was a 2.2% gain compared to last year’s share of 15.3% but was a 0.4% decrease from last month’s estimated 17.9% market share.

Graphic: Cox Automotive

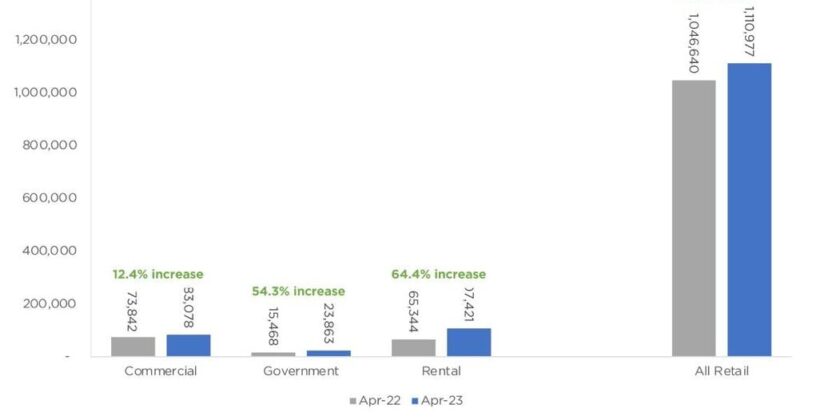

Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 38.6% year over year in April to 214,362 units, according to an early estimate from Cox Automotive.

Combined sales into large rental, commercial, and government fleets have seen nine consecutive months of double-digit, year-over-year increases. Sales into rental fleets were up 64.4% year over year, sales into government fleets were up 54.3% and sales into commercial fleets were up 12.4%. Fed by higher inventory levels and a healthy dose of fleet deliveries, April new-vehicle sales finished higher than the Cox Automotive forecast.

Fleet Share of Retail Sales Increases Again in April

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 6.1%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 13.4 million, up 1.3 million from last year’s pace, and up 0.5 million from last month’s 12.9 million pace. The fleet market share of 17.5% was a 2.2% gain compared to last year’s share of 15.3% but was a 0.4% decrease from last month’s estimated 17.9% market share. For comparison, nearly 22% of all vehicles sold in 2019 were through fleet channels. In 2022, the market shifted dramatically, with the fleet share of sales closer to 16% in many months as automakers focused on keeping retail channels stocked.

Insights: Fewer Kinds in the Vehicle Supply Chain?

“The major automakers appear to be preemptively pulling the fleet lever to stymie any significant increase in retail inventory,” said Charlie Chesbrough, senior economist at Cox Automotive, in a news release. “April’s new-vehicle sales were driven by larger-than-expected sales into fleet, particularly in the rental channel, but we haven’t seen clear evidence that overall new-vehicle demand is waning either. However, automakers aren’t taking any chances.”

Among large manufacturers, Stellantis, followed by GM, had the largest volume gains in fleet over last year. No automaker had less fleet volume in April compared to last year, but Toyota had the smallest gains.

Source: Read Full Article