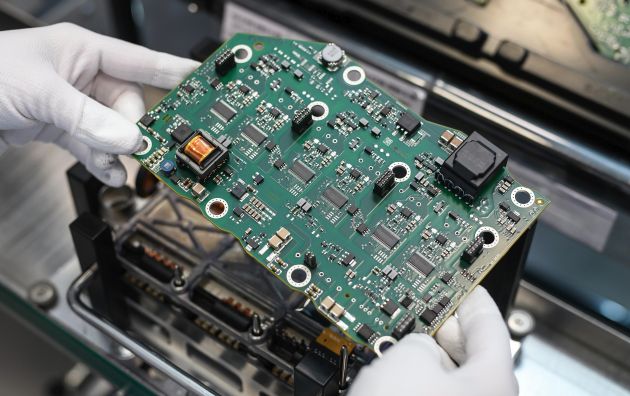

Production delays, cutbacks, and temporary factory closures are among several ways automakers have chosen to weather the global semiconductor shortage. But seeing as there is still no light at the end of the tunnel, carmakers are starting to feel the pinch and have resorted to desperate, if a bit creative measures to overcome the problem.

According to a Bloomberg report, Nissan will be omitting the GPS navigation systems from thousands of new cars, Renault has stopped offering the fully digital instrument cluster in the Arkana, and Ram will temporarily cease to offer the intelligent rear-view mirror on its 1500 pick-up trucks, just to save on chips.

The unprecedented shortage is a historic one, and comes at a time when automakers are starting to produce much safer and smarter cars that require significantly more computing power. The collective production cutbacks will result in millions of vehicle sales to be lost this year, and experts say the situation will not get any better until 2022 at the very least.

Mark Liu, the chairman of Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading chipmaker, said his company can only begin to meet auto clients’ minimum requirement by June. Liu told CBS in an interview that the chip shortage could last until early 2022, but automakers simply cannot leave their factories idling that long.

Companies that are lucky enough to have secured what limited supply of semiconductors are allocating them to more profitable and popular models. Peugeot, for example, has announced that it will be replacing the digital instrumentation in the 308 with conventional analogue ones.

General Motors, on the other hand, is forced to build the Chevrolet Silverado pick-up truck without a certain fuel-economy module, costing drivers about 1.6 km per 4.5 litres of fuel. In a more extreme case, Nissan chartered a cargo flight to ship its chip supplies from India to the US, just to keep its North American production running.

One way automakers and suppliers can overcome this hurdle is to source for whatever chips that are available, including those that have been produced but fall short of standard quality specifications. These sub-standard chips, Bloomberg said, will not jeopardise the car’s safety systems, but could theoretically see the infotainment system or emissions monitoring systems malfunction in extreme weather conditions.

Sig Huber, a consultant at Conway MacKenzie and former head of purchasing at Fiat Chrysler, said automakers can purchase new chips and rewrite the software to do the same thing. Tesla revealed last week it alleviated issues by reaching out to new semiconductor suppliers, and then quickly writing new firmware for those chips.

Source: Read Full Article