Now that we’ve seen how our local automotive market performed in 2019, let’s see how it compared to other ASEAN countries. Keep in mind that while the Malaysian Automotive Association (MAA) has released figures for the entirety of 2019, not all organisations in the mentioned ASEAN countries have done so.

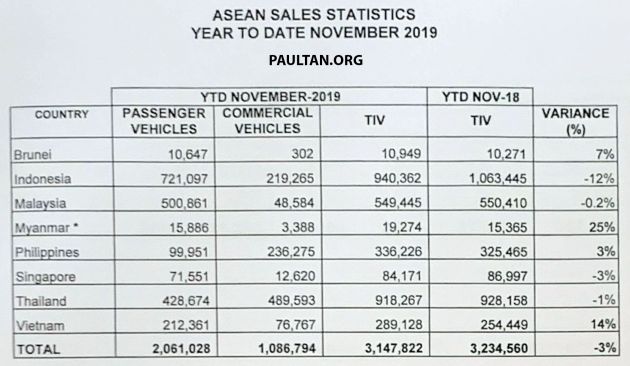

As such, the statistics you see here only cover sales recorded during the period of January to November 2019. Additionally, only eight of the ten ASEAN countries – Brunei, Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam – are accounted for, with Cambodia and Laos not included. Of the eight, there is no local vehicle production present in Brunei and Singapore.

During the aforementioned period, a total of 3,147,822 vehicles were sold in the ASEAN region, which is a 3% decline from what was seen in 2018 where 3,234,560 units were recorded. Indonesia contributed the bulk of the figure with 940,362 units delivered – the result is 12% less than the 1,063,445 units recorded during the same period in 2018.

Coming in second place is Thailand with 918,267 units, which is only marginally less (-1%) than in 2018 (928,158 units), while Malaysia occupied the third spot with 549,445 units, or 0.2% down from the same period the year prior.

Further down the list, we have the Philippines that saw an increase in TIV by 3% to 336,226 units. The last of five countries with six-digit TIV is Vietnam with 289,128 units, a gain of 14% from the 254,449 units recorded during the same timeframe in 2018. The first country below the 100,000-unit mark is Singapore with 84,171 units (-3%), followed by Myanmar with 19,274 units (+25%) and finally Brunei with 10,949 units (+7%).

Shifting our focus to production figures, 3,858,458 vehicles were produced during the January to November 2019 period, with Thailand at the top this time, producing 1,879,502 units (-6%). This is followed by Indonesia with 1,188,078 units (-5%) and Malaysia with 528,333 units (+1%).

Both the Philippines and Myanmar recorded double-digit growth in terms of production, with the former notching up 87,864 units (+16%). Myanmar’s production hike was more substantial at 29% with 14,042 units, with the start of SKD/CKD production there being a primary reason for the big jump. Meanwhile, Vietnam experienced a decline of 13% to 160,639 units in 2019 from 184,173 units in 2018.

Related Cars for Sale on

Source: Read Full Article