During the recent 2019 Nissan Futures event in Hong Kong, the Japanese carmaker announced that it is aiming to electrify one fourth of its sales volume in Asia and Oceania by 2022, as part of its Nissan M.O.V.E. midterm plan. This year’s symposium builds upon what was discussed in Singapore last year, and centres around the theme of “transform the way we live and drive.”

“Nissan is taking leadership to drive awareness and embracing of electrified mobility in Asia and Oceania. We are creating excitement by bringing the new Nissan Leaf to more markets in the region and introducing in Indonesia and the Philippines is a key step. This allows customers to get first-hand experience with the benefits of electric vehicles for themselves and for societies,” said Nissan regional senior vice president and head of Asia & Oceania Yutaka Sanada.

Sanada stated that the second-generation Leaf will arrive in Indonesia and Philippines in 2020, bringing the total number of countries set to receive the EV up to nine. At last year’s edition of Nissan Futures, it was revealed that the Leaf will be launched in seven countries – Singapore, Malaysia, Thailand, Hong Kong, South Korea, Australia and New Zealand.

Aside from expanding the market reach of the Leaf to nine countries, the midterm plan also includes the introduction of e-Power models in the region. Singapore is set to be the first country in the region to receive an e-Power model, with the Serena e-Power set to be launched there later this year. Previously, Edaran Tan Chong Motor (ETCM) said it is looking to bring e-Power to Malaysia, and the MPV could be a very viable option.

To further expand the accessibility of these electrified Nissan vehicles in the region, Sanada said the company is looking to begin assembly and localisation of electrification components in key markets in Southeast Asia. Thailand is said to be among the markets where Nissan has an interest to assemble electrified vehicles, after the carmaker gained the approval of Thailand’s Board of Investment (BOI) for its hybrid electric vehicle production project on July 25, 2018.

From a Malaysian context, the Leaf would have to be locally assembled in order to qualify for incentives under the current Energy Efficient Vehicle (EEV) scheme, so ETCM would either have to invest in its assembly plants to build the car as a CKD, or negotiate with government to avoid having to slap a sizeable price tag that comes with a fully imported (CBU) EV.

Of course, introducing electrified vehicles is just one aspect of a much larger equation. There’s also the matter of ensuring the markets being entered are prepared to welcome such vehicles, be it in terms of government policies, charging infrastructure and suitability for autonomous vehicles to operate.

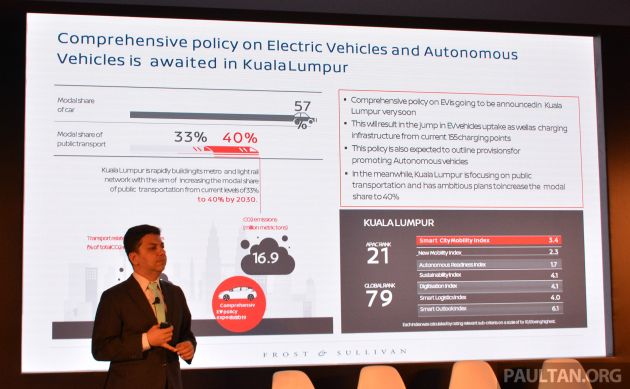

With that in mind, Nissan commissioned Frost & Sullivan to prepare a report based on the market research firm’s Smart Mobility City Tracker Study titled ‘Identifying Smart Mobility Opportunities in nine key cities’. The purpose of the report is to identify and examine the preparedness of the selected cities to receive electric and autonomous vehicles, which in turn have an effect on issues like pollution, urbanisation and congestion.

The selected cities that are involved in this report include Bangkok, Jakarta, Ho Chi Minh, Manila, Seoul, Hong Kong, Singapore, Sydney, and of course, Kuala Lumpur. These nine cities were then clustered based on per capita gross domestic product (GDP) and car penetration for further analysis, with Cluster A (high per capita GDP, high car penetration, low modal share of public transportation) consisting of Sydney and Kuala Lumpur.

Cluster B (high per capita GDP, low car penetration, high model share of public transportation) had Seoul, Hong Kong and Singapore, while Jakarta, Bangkok, Ho Chi Minh and Manila were in Cluster C (low per capita GDP, low car penetration).

Looking at our very own capital city, the report revealed that Kuala Lumpur (Smart City Mobility Index of 3.4) is awaiting a comprehensive policy on electric vehicles, which points towards the upcoming National Automotive Policy (NAP) that has been long overdue.

In November last year, deputy minister of international trade and industry Dr Ong Kian Ming said that the new plan will incorporate electric vehicles and autonomous driving technologies. Frost & Sullivan expects that with the introduction of the new policy, the uptake of EVs will significantly increase in Malaysia, supported by an expansion of charging infrastructure.

Our neighbours to the south, Singapore, fared much better with a higher Smart City Mobility Index of 7.6. In the recent months, the island republic has been steadfast in conducting its autonomous vehicle trials, while also electrifying its fleet of buses and increasing the number of charging points to 2,000 by 2020.

Singapore’s fellow cluster member, Seoul, also ranked well in the report, with plans to install 1,500 fast chargers to encourage EV uptake. The city’s intention to roll out 5G connectivity is also a boon to autonomous vehicles which can help further the efficiency of public transport in the city.

On the other hand, Hong Kong has yet to outline a clear policy on autonomous vehicles, but is introducing electrified buses and after treatment for diesel-powered vehicles to make its public transport more environmentally friendly.

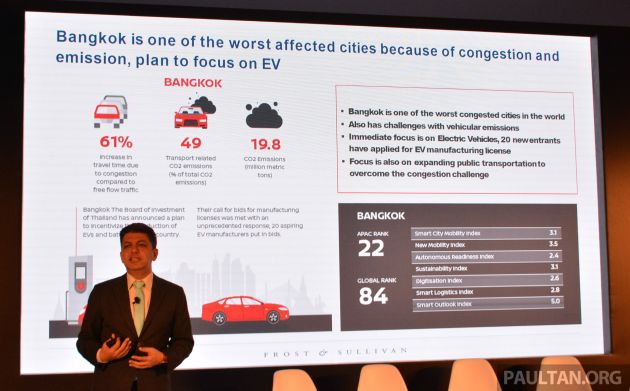

Cities that are in Cluster C had a mixed bag of characteristics, with congestion being prominent among most of the four cities. In the case of Bangkok, pollution resulting from transport was so severe recently that it triggered the return of smog to the city. The authorities has since recognise the importance of EVs to combat vehicular emissions, offering incentives to manufacturers to set up production facilities here, with Nissan being among the 20 entrants that have applied for the license.

Meanwhile, other cities like Manila and Ho Chi Minh are looking to electrify their current public transport vehicles rather than going all out to push EVs to consumers. Given the dense and congested nature of the city, introducing more vehicles would likely worsen the situation, hence the need to improve public transport from an efficiency and environmental standpoint.

Senior vice president of mobility at Frost & Sullivan, Vivek Vaidya, who presented the report, stated that there’s no all-encompassing plan to combat pollution, urbanisation and congestion, and that it is interesting to highlight the customised solutions that are being carried out city-by-city.

However, one key takeaway from the presentation is that governments have a critical role to play in the promotion of electric vehicles. This sentiment has been echoed even during last year’s event, and it involves policy making, infrastructure availability and lower barriers of entry for customers.

Apart from Sanada’s keynote address and Frost & Sullivan’s report, Nissan Futures also featured panel discussions touching on the topics of smart cities and mobility, as well as presentations on the the future of autonomous mobility and Nissan’s outlook on energy.

During ‘The Future of Intelligent Mobility’ presentation, chief technology director at Alliance Innovation Lab – Silicon Valley, Maarten Sierhuis stated that Nissan views an autonomous system as a holistic that will continue to have humans-in-the-loop. “Show me an autonomous system without humans-in-the-loop and I’ll show you a useless system,” said Sierhuis on stage.

For a better understanding of this viewpoint, Sierhuis, who used to work at NASA, views an operator as necessary in an autonomous driving network to deal with environments that are dynamic. The idea is so a human is capable of guiding an autonomous vehicle in situations where on-board artificial intelligence (AI) is faced with certain scenarios. Over time, recurring solutions can be reused, making on-board systems even more effective and independent.

Nissan calls this development SAM or Seamless Autonomous Mobility, and it is an area that the company will continue to work on to further improve its ProPILOT autonomous driving technologies to be able to provide higher autonomy levels from the current Level 2 capability.

Lastly, Nicholas Thomas, global director of the electric vehicles division at Nissan, presented his ‘The Future of Energy’ keynote, whereby he acknowledges that customers need a complete solution for their vehicle and its integration into society.

With higher demand for EVs globally and electric powertrains being more affordable than in the past, Thomas proposes that electric vehicles like the Leaf is capable of transforming the tradition uni-directional energy distribution model (generation to consumer) to a bi-directional model that promotes flexibility from demand, generation and storage.

Expanding further, Thomas stated that the traditional demand and supply curve relating to electrical load profile requires a certain amount of energy capacity (with a safety margin) to service peak demand periods. With the uptake of EVs, this load profile could change as consumers create a new peak when they plug their vehicles in for the night, resulting in a higher energy capacity requirement.

However, while most EVs have sizeable batteries these days, most (if not all) consumers will not exhaust the energy capacity of their EV batteries on the daily drive. The stored energy that is unused creates an opportunity to balance the demand and supply curve with a potentially lower peak energy capacity requirement, and thus, reduces infrastructure investment.

This potential solution is being demonstrated by the Leaf, which comes with the V2X standard bi-directional charging technology, allowing you to not just charge the battery, but also using the battery to partially power external electrical loads such as buildings, homes or power grids. Pilot projects with V2X have already begun in other countries, including in Japan.

Source: Read Full Article