The cabinet of Thailand has recently approved a proposal from its finance ministry to remove the excise tax for full electric vehicles from January 1, 2020 to December 31, 2022. The move is aimed at speeding up EV production in the country, as well as to combat pollution, Bangkok Post reports.

Currently, the excise tax rate in Thailand for EVs with BOI incentives is 2%, while those without it are subjected to an 8-10% excise tax.

However, only companies that have secured promotional privileges from Thailand’s Board of Investment (BOI) will get to enjoy this tax-free period. Among the 13 manufacturers that have received the approval of the BOI include Honda and Nissan.

The latter received the approval of the BOI for its hybrid electric vehicle production project on July 25, 2018. Under the project, the Japanese carmaker will invest 10.96 billion baht to produce hybrid electric vehicles and batteries, as well as e-Power models at a facility located in Bang Saothong in the Samut Prakarn province.

Nissan has already begun offering the second-generation Leaf in Thailand, albeit at a rather heavy price tag of 1.99 million baht as it comes fully imported from Japan. All EVs entering Thailand are subject to an import duty of 80% based on cost, insurance and freight. With local production, the price of the Leaf will likely be reduced severely.

As for Honda, it will invest 5.82 million baht and use local content valued at 2.77 million baht to kickstart production of hybrid electric vehicles and HEV batteries at its facilities in Rojana Industrial Parks in Ayutthaya and Prachinburi provinces.

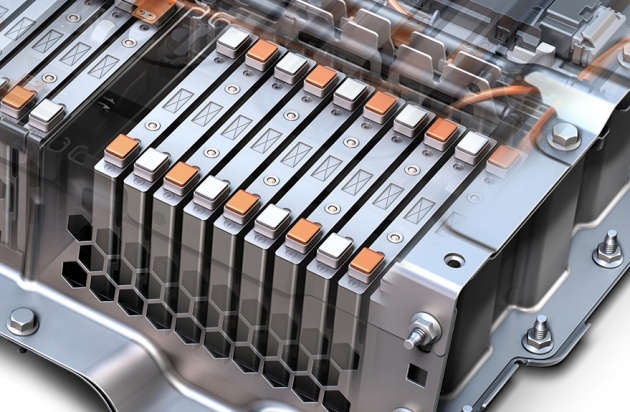

On a related note, Thailand’s excise department is also considering reducing the 8% excise tax levied on EV batteries to support local battery production. The scale of the proposed tax cut is still uncertain as factors such production costs, processes and whether the battery cell or module is imported or locally assembled.

Batteries that are already installed in cars are exempt from the 8% excise tax, as they are charged based on the car’s value, which would also apply to EVs.

Away from electrified vehicles, Thailand’s cabinet agreed to reduce the excise tax for passenger pick-up vehicles with CO2 emissions of less than 200 g/km and smaller than PM 0.005 to 2% from the current 2.5%.

As for trucks with emissions higher than 200 g/km, they will be taxed at 3% from 4%. Double-cab pick-up trucks are also subject to these revisions, with the former now taxed at 9% from 10%, while the latter is at 12% from 13%.

The government says it is sacrificing revenue of up to 1.5 billion baht a year with these tax cuts, but views it as a necessary move to reduce emissions and pollution.

Related Cars for Sale on

Source: Read Full Article