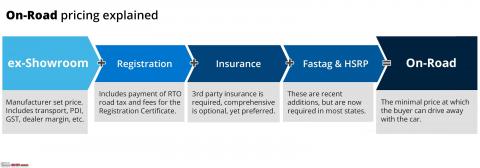

On-road price is nothing but the final price that the buyer pays. It includes the following:

1. Ex-showroom price – This is the manufacturer-fixed price of the vehicle. It consists of all charges including manufacturing, transport, dealer’s margin, pre-delivery inspection (PDI) costs and the GST levied on the car.

2. Registration – This includes the RTO road tax, as well as fees for the Registration Certificate (RC).

3. Insurance – While registering for 3-year 3rd party insurance is mandatory, most new car buyers opt to go for a comprehensive insurance policy that offers more protection.

4. Fastag & Number plate – Fastag and High-Security Registration Plates (HSRP) are now compulsory in most of the states and are usually charged a nominal amount of Rs. 600 combined.

In short, on-road price = Ex-showroom price + RTO road tax + Insurance + Fastag & Number plate

Ex-showroom Price:

One of the positives of the new GST regime has been the simplification of taxes. Prior to GST, the ex-showroom cost was made up of ex-factory vehicle cost, excise duty, cess (if any), delivery charge to dealer’s location and sales tax. In some localities like Mumbai and Navi Mumbai, an additional octroi duty or local body tax was also levied respectively.

These days, the taxation is much simpler. Also, most manufactures have a pan-India ex-showroom price, which can usually be found on their website.

As seen from the attached table, the tax component on cars has gone down for all, with the only exception being hybrid vehicles. Sadly, the Toyota Camry has become a victim of this, and it caused a significant hike in prices post the implementation of GST.

Registration:

Thanks to digitisation of the RTOs, the data required for calculating Road Tax is taken directly from the Vahan portal, where car makers have uploaded the information directly. An added step here is that dealers have to add the owner details before sending out the car for registration. Road tax varies across states and keeps changing from time to time. Use this Parivahan link to check the road tax in your state.

Road tax is usually a flat percentage figure (rounded up to the next integer) to be paid on the ex-showroom price. Nominal costs like RC fee and courier charges need to be paid along with the tax to the RTO.

If you are opting for a number of your choice, additional charges are applied according the number you want.

Delivery and handling charges:

This is a big point of contention among the car buyers out there. Broadly speaking, there are 3 types of handling charges:

- Included in ex-showroom

- Excluded from ex-showroom, albeit set by the manufacturer

- Arbitrary charges levied by dealers

Depending upon the manufacturer, you might have to pay an additional charge over and above the car’s ex-showroom rate. It is still a grey area, legally speaking, as different jurisdictions implement the rules differently. Premium car dealerships will often include a charge for a flat bed to take the car to and from the RTO you want the car registered at. As their dealer network is thin, they may not have a dealership in the place where you want the car registered. They might also arrange home delivery if you so desire. From my experience, most of the premium car dealers will negotiate an all-inclusive cost and specify all the inclusions. However, they might not share the breakup with you for the add-on services like service fees for delivery / flat bed etc.

Quoting blackwasp here as this post is relevant even now:

I would like to add a different take to the handling charges. While many of us consider them to be illegal, I thought I’d share my experiences.

Case 1: Companies like MSIL, which include all their costs – logistics, PDI, fuel etc. and combine it in the ‘ex-showroom’ that is given to you.

Here, as a customer, you end up paying more money in the form of taxes as you pay the GST (upto 53% depending on segment) + road tax, insurance, etc. on a higher ex-showroom price.

Case 2: Companies like Renault, Fiat, VW, that bill you separate logistic charges / handling charges / PDI charges.

Here, this is not added to the car’s base price, and it is billed as service, attracting a lower tax on this amount. Further, your road tax and insurance will be slightly lower as well since your base price is not inflated.

Now, it must be noted that you check with the company directly and check if it’s the approved figure and that the dealer is not trying to pull a fast one on you. Also, they must give you a separate invoice for this.

Case 3: Companies like Isuzu.

The standard accessories in the car are billed separately, so further lower the car’s base price. Yes, as a buyer, you end up paying a total amount, but had they included the accessories’ cost, you’d again end up paying higher tax and more on it.

While I agree that when buying a car, we don’t want to pay any extra charges, it’s best to get a thorough look into the pricing and take a call. I recommend all to call, email and double check with the respective company officials on the approved charges in different states and cities. And ask for separate invoices for all charges – e.g. accessories, handling charges, car base price, insurance etc.

EDIT – Regarding dealerships charging under registration charges – this is optional. The dealership may charge it, but it should also give you the option of doing the registration on your own if you don’t want to pay for these services. High end car dealers will add charges for a flatbed to take your ride to the RTO of your choice and back

Insurance:

3-year 3rd party insurance is now compulsory on every new car purchase. Most dealers will offer you a 1 year comprehensive + 3 year 3rd party bundle offer. There are add-ons like zero depreciation, return to invoice, engine protector, Road Side assistance, etc. that should be selected as per your requirement. You can also opt for a 3 year bundled plan which will save you some money compared to renewing every 3 years in lieu of higher upfront payment.

Dealers are keen to have you purchase the insurance from them as they add their margin to the insurance quote. However, it’s important to note that you are under absolutely no obligation to purchase insurance from them. Usually, getting the insurance directly from the insurance provider, or browsing the market for other resellers & aggregators will end up being cheaper – but will take up more of your time. Whichever option you choose, ensure you read the inclusions and exclusions of the policy carefully before finalising.

Fastag and Number plate:

Fastag has been made compulsory for new vehicles across India. Usually the dealer has a tie up with a particular operator and will include the same in the total price quoted to you. The actual cost of the tag is Rs. 100 and you need to maintain a minimum balance of Rs. 200. Add some usable balance to it and the total cost to you should be around Rs. 500 (100+200+200). Get the latest updates on Fastag operators & charges at this Team-BHP Fastag discussion.

High Security Number Plates (HSRP) have also been made mandatory in many states. These are available for Rs. 500 a pair. Some dealers will include a frame as well for a nominal cost.

Additional / Optional Costs:

Along with your new car, you might also choose to purchase an extended warranty, a service plan or some accessories. These also need to be factored in as additional costs.

Discount:

This really comes down to the negotiation between the dealer and you. As a thumb rule, cars with the dealer which are older inventory or less popular variants & colours can get you a higher discount. Latest launches and those which have a long waiting list will not be offered with any discount.

Tips:

- Check insurance rates from outside, on platforms like CoverFox, PolicyBazaar etc. They could offer a better deal.

- Be aware of the handling charges and do proper diligence.

- Before you take delivery, insist on getting the number plate fixed. Avoid leaving any items pending, as they can drag on for a long time – e.g. accessories not in stock, documentation etc.

- Compare the quoted road tax amount and the actual receipt. Dealers are known to inflate this slyly.

- Be aware of Debit notes. In case of any discrepancy in the actual payment vs the receipts, the dealer will issue you a debit note for the difference in the amount. Insist on a proper receipt for it.

- Note that discounts are almost always applied on the on-road price, not the ex-showroom price. This means they won’t reduce your road tax and insurance component. This is because the RTO will have its own pricelist for cars and will usually not deviate from it apart from genuine reasons like selling old inventory or the car being discounted by the manufacturer itself. Case in point, in 2016, I could get my Abarth at a lower ex-showroom price as it was a 2015 make, but the inspector did call up the dealer and confirmed the same. For mass market cars like Maruti, Hyundai and Tata, this may not be the case.

- Preferably get confirmation about the transaction and the overall deal on email before paying the whole amount.

- Make sure you do a PDI.

Source: Read Full Article