It’s no secret that everyone wants a piece of that Tesla pie. The electric automaker’s stock price has soared to astronomical heights this year, and on Monday, Tesla officially joined the S&P 500 index, putting it among the ranks of Apple, Amazon, Facebook, Microsoft, and other notable large, publicly traded companies. But what does that mean for you?

In short, it means that Tesla is becoming a household name—more than it already is. Despite having only a fraction of the deliveries that automakers like General Motors and Ford generate in one year, Tesla’s valuation has catapulted to nearly seven times their combined value. This has led to some turmoil and disagreements among financial analysts, and the inclusion of Tesla in the S&P 500 has proved to be quite a hot-button topic to investors.

What Is the S&P 500 and Why Does It Matter?

The S&P 500 is a stock market index that measures the stability and performance of approximately 500 U.S.-based companies across 11 different sectors to give investors a quantification of overall market performance. As a set of common rules, the companies must be structured as corporations that offer common stock to the public (and are listed on an eligible exchange), have a market cap of at least $8.2 billion, and have posted a profit over the four most recent fiscal quarters.

Tesla became eligible to join the S&P 500 after it posted a fourth consecutively profitable quarter in Q2 earlier this year. The company’s market valuation has continued to climb since, all the way to its present-day cap of $659 billion, which makes it the sixth-largest overall corporation measured in the index as of Monday. In fact, its size makes the company’s weight to the overall index of roughly 1.69 percent. This means that for an $11.11 move, the index would move one point.

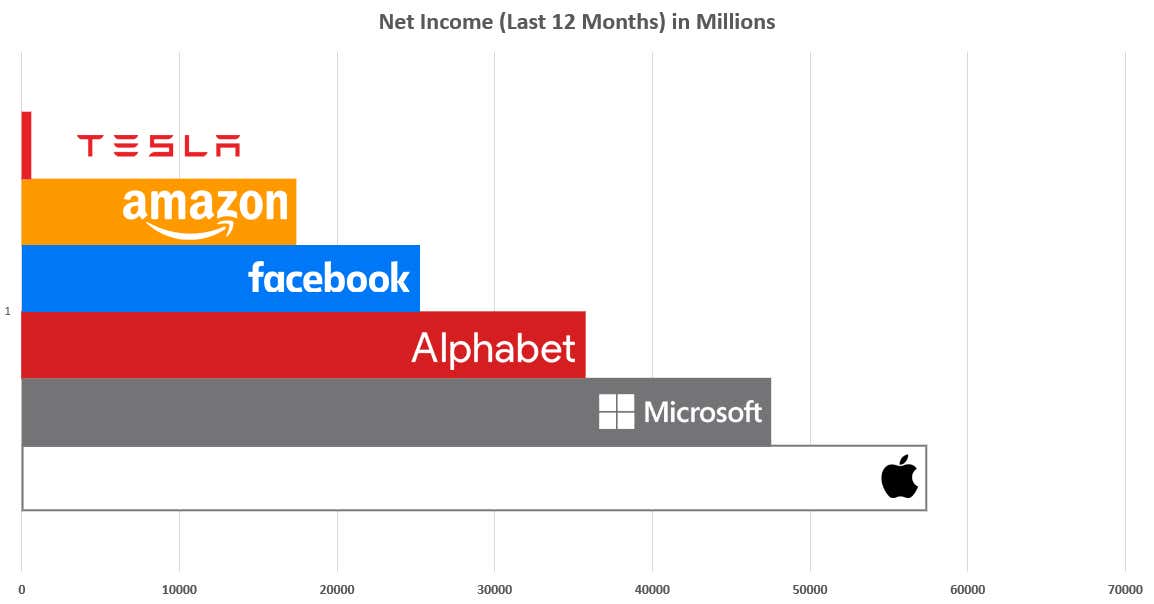

Tesla’s net income for the last 12 months is roughly 3 percent of the next-highest valued S&P 500 neighbor, Amazon.

Including the automaker into the S&P 500 solidifies its footing as a seemingly stable security, something which has been debated by financial analysts around the world for some time. Earlier this month, for example, JP Morgan called the stock “dramatically” overvalued by “virtually every conventional metric” and predicted that the stock’s valuation would suffer a nearly 86 percent reduction within the next twelve months.

Other analysts are torn on whether to buy, sell, or hold shares. According to Business Insider, the stock has 20 “buy” ratings, 44 “hold” ratings, and “19” sell ratings—averaging to a nearly entirely neutral recommendation by analysts.

Tesla’s Unusual Tie to the Stock Market

Tesla is a unique animal in the automotive world, and increasingly, in the world of global business writ large. No other automaker, nor its owners, are so publicly fixated on the price of the company’s stock. This has led to quite a cult-like relationship between the company’s image and its valuation. (And it’s gotten CEO Elon Musk into trouble at times.)

In fact, analysts from JP Morgan have pointed this out previously, claiming that the stock is fueled by “speculative fervor.” If that were true, it would explain the razor-sharp relationship between image and valuation, a means previously used to disregard some criticism as smear campaigns by individuals in a position to capitalize from short selling.

And people certainly did capitalize on Tesla’s venture. Let’s say you purchased one share of Tesla before its one-to-five stock split at $2,230. Today, at the opening of the market it would be worth $3,325—approximately a 50 percent gain in just four months. If the stock was purchased in January 2020, it would have grown more than 700 percent by today, or for lack of better words, quite a profitable return on investment.

The concept of short-selling could be seen as artificial inflation and deflation of the stock, which hurts those in a traditional long position should they decide to sell while the stock is in a dip, or should the valuation of the stock begin to fall as a whole. The latter is a topic which short-sellers often hedge on, especially as the EV market becomes more densely packed with both legacy automakers and additional newcomers who are being vetted just in case they prove to be “the next Tesla.”

Tesla’s inclusion in the S&P 500 shouldn’t be downplayed—that’s a big achievement. But aspects of its future are still very uncertain. Though it’s posted several profitable quarters, it only posted its first annual profit this year. And it continues to be beset by production problems, quality issues, meeting deadlines and actually delivering on the many bold promises made by its bombastic CEO.

This could spell trouble for shareholders, especially as legacy automakers continue to catch up to Tesla’s once-significant lead. Where Tesla stock will land in the future is anyone’s guess.

Source: Read Full Article